maryland digital advertising tax statute

Digital advertising services taxes. Marylands digital advertising law imposes a tax on a percentage of revenues that advertising platforms with over 100 million in annual global revenue earn from digital ads that are served in Maryland.

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

Until two days before the early end of the 2020 legislative session House Bill 732 HB 732 focused on the taxation of cigarettes electronic smoking devices and.

. One of the provisions the Act states that the applicability of the Digital Advertising Gross. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021. Taxation of digital advertising services.

Overriding the governors veto of HB. 2 imposes a new gross receipts tax on digital advertising within the state including banner and search engine ads website or application ads and ads within a piece of software. The Maryland General Assembly on April 12 2021 passed Senate Bill 787legislation that revises two digital services tax laws enacted earlier this year.

Maryland digital advertising gross revenues tax. The state tax on gasoline is 235 cents per gallon and diesel fuel is taxed at 2425 cents per gallon. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled in by large companies.

In other states proposals are targeted to digital advertising revenues earned by social media providers. The new tax on revenue earned from digital advertising applies a graduated rate based on the taxpayers global annual revenue applied to an assessable base annual. Ferguson Edward Bernert and David Ebersole on May 7 2020 Posted in Advertising.

The bill is pending action by the governor who has 30 days to sign veto or allow the bill to become law without his action. Chamber of Commerce the Internet Association NetChoice and the Computer and Communications Industry Association filed a detailed complaint in federal court in Maryland Thursday asserting the new Digital Advertising Gross Revenues Tax is clearly discriminatory. Marylands Digital Ad Tax Under Pressure from Big Tech.

The statute defines digital advertising services to include advertisement services on a digital interface including advertisements in the form of banner advertising search engine advertising interstitial advertising and other comparable advertising services The tax is imposed on the portion of a taxpayers annual gross revenue derived from digital advertising. On March 18 the Maryland General Assembly passed the first state gross revenue tax directed at digital advertising which is broadly defined to encompass any advertising appearing on a website mobile app or any similar digital platform House Bill 732. In other words this part of the new law will allow DGS to claim a refund of the tax on motor fuel that it purchases for use by state agencies.

Maryland estimates the digital tax could raise as much as 250 million in its first full year by taxing annual gross revenues derived from types of. Applicability Date of Digital Advertising Gross Revenues Tax Delayed On April 12 2021 the General Assembly of Maryland passed Senate Bill 787 an Act concerning Digital Advertising Gross Revenues Income Sales and Use and Tobacco Taxes Alterations and Implementation. February 19 2021.

The Act requires persons to pay a tax at rates between 25 percent and 10 percent on annual gross revenues of such person. As expected the Maryland law that created an online advertising tax is facing legal opposition from lobbying groups backed by Amazon. On February 12 2021 the Maryland General Assembly voted to override Governor Larry Hogans veto of House Bill 732 which carried over from the close of last years legislative session and enacts the nations first gross receipts tax on digital.

The suit lands most of its blows under the Internet Tax Freedom Act which. Accordingly the digital advertising services tax measures are enacted and effective for tax years beginning after December 31 2020. Maryland Passes First-of-Its-Kind Digital Advertising Tax.

Taxation of digital advertising services. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. 732 on February 12 2021 making Maryland the first state in the country to adopt a tax on digital advertising.

This particular part of the new law becomes effective July 1 2005. Tax on digital advertising services enacted Marylands legislature on February 12 2021 voted to override the governors veto of legislation imposing a new tax on digital advertising. After more than a year of contention Marylands proposed digital advertising services tax has become law the Act.

The Maryland Tax is a gross receipts tax on digital advertising services defined to include advertisement services on a digital interface including advertisements in the form of banner advertising search engine advertising interstitial advertising and other comparable advertising services. Certain states have pending proposals similar to the new Maryland law that would impose tax on persons deriving revenue from digital advertising services. By Gerald J.

Maryland digital advertising tax statute. For companies making more than 100 million but less than 1 billion in global revenue the law imposes a 25 tax on money generated from selling digital advertising services in the state. Just days after Maryland became the first state in the country to impose a tax on digital advertising targeting Big Tech lobbying groups representing companies including Amazon Facebook Google.

Review of Marylands Digital Advertising Gross Revenues Tax. On February 12 2021 the Maryland Senate voted to override Governor Hogans previous veto of the legislation. As mandated by the maryland constitution the tax will take.

Illinois Compiled Statutes Annotated State Court Rules Annotated Lexisnexis Store

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Model Of And Construction Of The Statue Of Liberty In 1883 Statue Of Liberty History Pictures History

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland S Digital Ad Tax Faces Litigation But Tax Could See Broader Adoption S P Global Market Intelligence

Digital Ad Tax Argued In Maryland Federal Court Case The Seattle Times

Md Digital Advertising Tax Bill

Digital Ad Tax Argued By Attorneys In Maryland Federal Court Case Wusa9 Com

Judicial Code Supplement Title 28 And Related Statutes Lexisnexis Store

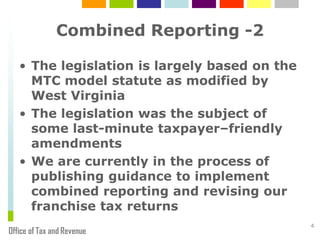

Doing Business In Dc Dc Business Taxes Office Of Tax Reveneu

Nevada Roadmap To The Right Of Publicity

California Roadmap To The Right Of Publicity

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments